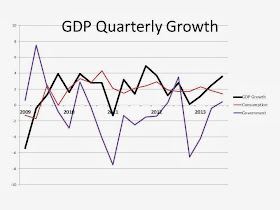

GDP growth for the third quarter of 2013 surprised economists, coming in at a robust 3.6%. One component that helped is government spending, which grew for the first time in 5 quarters.

In the four years since the end of 2009, government spending has grown in only 4 of 16 quarters (and in one of those four quarters it came in at a paltry 0.3%).

Consumption - the biggest portion of GDP - has been fairly stable through this (slow) recovery. The private sector has had its foot on the gas while government has had its foot on the brake. No recovery since WWII has been more oddly resisted by government policy.

During the recovery in the early 1980s, Reagan led a surge in government spending. In the 16 quarters after the recession's end, government spending went up at an average rate of 5.4%. By contrast, during our most recent 16 quarters, government spending has contracted at an average quarterly rate of 1.6%. That difference of 7% is huge.

Note that during the Reagan recovery (approximated here with data from 4Q82 to 3Q86), government spending actually pulled GDP growth up, exceeding the rate of growth for the whole economy. More recently, our government spending has been significantly lower than GDP growth, causing a drag on the whole economy and this recovery.

The private sector may be doing as well as it has in past recoveries; it is the government sector that has made the difference. And given that is something elected officials can directly control, that is a shame.

Reagan and W spent increased federal employment and directly gave massive amounts of federal money to States and local municipalities in order to stimulate the economy and keep unemployment numbers low.

ReplyDeleteOf course, it's part of the Republican Two-Santa Theory. Good Post.