2016 is going to be a great year for the American economy.

There are a number of reasons why. One reason is that Paul Ryan negotiated a deal with Obama to avoid another October standoff on the budget. It's good for everyone to know that 20% of the economy (roughly the size of the federal government) is not going to suddenly grind to a halt.

On a related note, spending at every level of government - federal, state, and local - should rise the most it has since the start of this decade. This is going to help with GDP growth rather than hinder it, as it did in the beginning of the recovery. Not since the Great Depression has a recovery relied less on government spending and starting now, the private sector won't be the only engine that needs to pull this train.

Another positive is that the largest age group in the population is 20 to 24 year olds (see Bill McBride's great post here on this and other reasons to optimistic). That age group is making the transition from college to work now and will be one reason that the decline in labor participation rate will start to rise again.

This will help to drive up household income. By the end of 2016, household income should be back up to its 2008 level of $55k, perhaps even $57k, where it was in 2007 and in the late 1990s. (One rarely mentioned reason it has fallen in this century is simply that household sizes are trending downwards.)

The birthrate rose in 2014 for the first time since 2007. That's good for the economy for a number of reasons. It shows optimism and babies drive new purchases of clothes, cars and homes.

That's one of the reasons that residential construction spending will continue to rise, going up by double-digits (10% to 15%). This drives the purchase of furniture and household appliances and so many other things. That is, it drives up consumption.

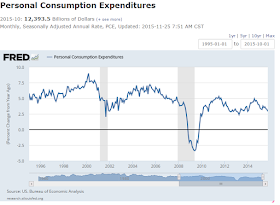

Personal consumption will go up by at least 5%. The debt service costs for households is at a record low. People are quitting jobs about 2X faster than they are losing them, showing growing confidence in the job market. More confidence about future income and less worry about old debt will contribute to consumer spending rising at the rate that it did before the Great Recession (which is to say, above 5% rather than below it). This is going to help GDP growth and company profits.

Speaking of job growth, there is a great chance that the American economy will create more than 2 million jobs and a decent chance that it will create more than 3 million. In either case, the years 2014-2016 will mark the best three year total for job creation since 1997-1999. Oh, and this absurd streak of uninterrupted job growth might even extend from 63 months (what it'll be at the end of this year) to 75 months. Again, the old record was 48 months of consecutive job growth.

This job growth will do two things. There is a very good chance that it will bring down the unemployment rate to 4.5%. It will also will raise wages, as demand for new employees does once unemployment drops below 5%. (When unemployment is above 5%, it is easier to hire out of the ranks of the unemployed and there is little reason to offer high wages. Once unemployment drops below 5%, job offers more often have to entice employees away from current jobs, driving wages up.)

Wages are a little tricky, though. As you can see in the graph below, wage growth has been considerably lower than it was before the turn of the century but it is also true that inflation is much lower. So, nominal wage growth hasn't been too impressive but after-inflation wage growth is actually pretty strong. If wage growth rises a bit more even as inflation stays low, households will experience real increases in spending power, one more reason that consumption is likely to rise.

Finally, the driver that is hardest to predict but that looks so positive is the uptick in early stage entrepreneurial activity. This may well be the biggest reason to be optimistic about 2016. This early stage activity is the ultimate in leading indicators. Why? It takes years to make business plans real. If it takes a few years for early stage entrepreneurial activity to translate into significant growth in GDP and jobs, this indicator looks promising for 2016 - 2018. Between 2010 and 2014, early stage entrepreneurial activity nearly doubled. Even if it leveled off in 2015, this sort of activity is the most promising indicator of all; successful entrepreneurs are the ones who create new jobs and wealth.

Painful memories of the Great Recession may have receded far enough into the past that people are less reluctant to use their credit cards to shop and their savings to invest. Gallup forecasts Christmas spending will rise significantly this year and that may well put everyone - from manufacturers and retailers to households and employers - in a more generous, positive mood from the very first week of the new year.

Happy (about to be) new year everyone!

No comments:

Post a Comment