Four books that shaped my worldview.

Robert Wright's Nonzero

We can play zero-sum games in which every win comes from someone else's loss or play variable-sum games where the sum of what we win varies. Our modern world is variable sum and we can all lose, win or lose big, most win and some lose, some win and most lose, etc. In my old age I think one of the most defining things about a group or individual is whether they believe the world is zero-sum or variable-sum.

W. Edwards Deming's New Economics

Packed with insights but for me the biggest take away is that you can either focus on measuring how people are doing within the current system (from factory floor to classroom) or focus on measuring how well the system is doing at helping people to realize their potential. Deming's advocacy for getting rid of grades and instead nurturing intrinsic motivation feels more and not less important to me as I get older.

William Deci's Why We Do What We Do

Deci offers three models for parents, managers, teachers or political leaders: control, abandon, or autonomy supportive.

Control defines process and outcomes for your child, student, employee, or citizen.

Abandonment leaves them free but unsupported.

Autonomy supportive supports them to the point of autonomy, teaching, coaching and sharing what you know to get them to the point of pursuing whatever goals they have.

Csikszentmihalyi's Flow

Csikszentmihalyi's exploration of how we get lost in work, play or conversations - become absorbed in doing - left him convinced that a big key to happiness and productivity is attaining flow. I also loved his Evolving Self and at lunch one day asked him if it is fair to characterize Flow as about how to create engagement and Evolving Self about how to create meaning. He paused for a couple of minutes and then nodded. "Yes." Long pause. "Yes. That's a really good way to put it."

All of these are of a piece, it seems. Ultimately exploring the question of how we create the systems that let us realize our potential.

16 August 2022

09 August 2022

The Most Interesting Question About Investing

There are at least two elements to personal investing.

The first is the most obvious: how to find investments that promise the most return for the least risk. Anyone who tells you they have a secret formula or shortcut for this is either lying to you or have only been investing for a few years. Still, it is valuable to look for clues and sort out signals from noise in this space. There is a ton that gets said and written about this. Pay attention to some of it from time to time. You might learn something. And stay humble. (And of course you don't have to do the humbling on your own. Investments will inevitably do it for you.)

The other element of investing might be even more fascinating, though. When you invest you are buying futures. Obviously you are trying to pay, say, $100 for $200 in a year or a decade. You are hoping to buy a future that gives you more money than you have now, money enough that you don't have to work at 75 (or maybe you're shooting for 45). But beyond the personal future you're trying to buy, there is the question of what collective future you're trying to buy. If you buy stock in a company that is making flying cars, you are paying for that future. It may fail to materialize but that's the future you're buying, a future where people can fly around as easily as they drive around. If you buy stock in a company that is leveraging mRNA into new cures, that is the future you're trying to buy. Your investments could be an answer to the question of what kind of future you want to subsidize or accelerate.

If you could buy the future, what kind of future would you buy? That's an interesting conversation to have with your kids. Or even your neighbors' kids.

02 August 2022

A Ratio that Predicts Why We May Well Avoid a Recession

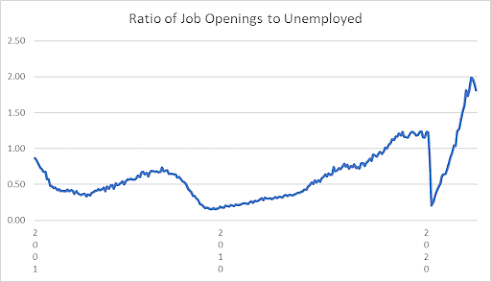

The ratio of job openings to the number of people unemployed is a simple measure of the health of the job market. This century, there have been an average of 62 job openings for every 100 unemployed people.

Jerome Powell is trying to lower inflation without causing much - or any - unemployment. The way he would do that is to bring down the number of job openings without bringing down the number of people who are unemployed. That strategy is looking distinctly possible.

For a variety of reasons, inflation seems to be dropping. Almost as importantly, to extent that Powell needs to "cool down" the labor market without triggering layoffs he seems to be doing that.

The ratio of job openings to unemployed people peaked at 200 job openings for every 100 unemployed people in March. That is triple what it has averaged this century. That is crazy.

As Powell has cooled the economy, this ratio has come down from 200 job openings for every 100 unemployed people to 180 job openings for every unemployed person. 180 is still far higher than its peak of 124 job openings for every 100 unemployed during the Trump administration. (And pre-COVID, that was a really strong job market.) The fact that Powell can bring this ratio from 180 / 100 down to 124 / 100 and still have a stronger job market than we had before COVID suggests that the Fed has a lot of room to maneuver without triggering a recession.

I know I am susceptible to optimism but this is really good news. If Powell lowers inflation without raising unemployment, it'll qualify as a very cool trick. Be prepared to applaud. And then exhale.

I know I am susceptible to optimism but this is really good news. If Powell lowers inflation without raising unemployment, it'll qualify as a very cool trick. Be prepared to applaud. And then exhale.

Subscribe to:

Posts (Atom)