The 1990s saw the rise of the internet and an economic boom. Al Gore – Senator from Tennessee before becoming Clinton’s VP - sponsored a National Information Infrastructure bill that passed into law in December of 1991, funding the development of the “information superhighway” with $600 million. The bill funded, among other things, the development of Mosaic, the first web browser. In 1990, only 15% of Americans even owned a computer. Between 1994 and 2000, the percentage of Americans online rose from 2% to 46%. Going online helped to make the 1990s better than the two decades before and after measured by wage growth and the creation of wealth and jobs.

George W. Bush took office after Clinton and quickly got to work deregulating the financial sector. Specifically, he made it easier to approve mortgages so that more Americans could buy homes. By 2008 the financial derivatives built atop mortgage loans equaled total global GDP and the bubble this created popped, leading to the worst recession since the Great Depression. The economy under Bush 2 was dramatically different than it was under Clinton and this wasn’t due to chance. Clinton and Gore pushed investments in the internet and other technologies and industries (the human genome was first sequenced towards the end of Clinton’s time in office). Bush bet instead on deregulation which blew up on him and the global economy.

Trump didn’t just undermine immigration and trade – big drivers for economic progress across the globe during Clinton’s administration. (It was not just NAFTA that became reality during Clinton’s administration; so did the World Trade Organization.) Trump refused to take any responsibility for fighting the pandemic beyond signing legislation for rapid development of vaccines, leaving each state and county largely unsupported in its efforts to test, treat and contain COVID. The pandemic hit the US harder than other OECD nations, killing more Americans and destroying more jobs. (And even after Biden took office, the vaccination rates were much lower and death rates much higher in the counties where Trump won a higher portion of votes.)

One of Biden’s first acts as president was to sign a $1.9 trillion bill to stimulate the American economy and more aggressively defend against COVID. This was a significant factor in the economy creating a record number of jobs in 2021. Not a single Republican voted for this stimulus bill; again, the simple uniting belief for Republicans is that markets don’t need interventions.

The key difference between Republicans and Democrats in office is that Republicans simply lower taxes and deregulate. By contrast, Democrats intervene with stimulus and investment bills.

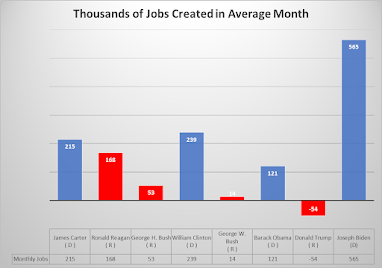

The difference was not just dramatic last year but for the last half century. In the 24 years Republicans have been in the White House since 1977, the economy has created 17.4 million jobs. In the 21+ years since 1977 that Democrats have sat in the White House, the economy has created 52.7 million jobs. An average of about 60,000 new jobs each month a Republican is in the White House compared to about 209,000 jobs a month when a Democrat is. There are people who will tell you that this is not a meaningful difference; these are the same people committed to the proposition that policy makes no difference and would have you believe that George W. Bush simply had bad luck rather than bad policy and that Clinton and Gore simply had good luck rather than good policy.

Keynes believed that financial markets were marvelous and necessary inventions and that without the right kind of policy intervention could blow up an economy and create ruin. He’s still right on both of those points even though it is fashionable on the left to revile financial markets for their tendency to create wealth inequality and those on the right to revile regulations or the need for government intervention.

Biden is old. One of the big advantages to this is that he’s seen – and learned – a lot. He knows what policy slows recoveries and what policy accelerates it. Obama had tasked him with cleaning up the mess George W. Bush had left behind in 2009. We voters tasked him with the task of cleaning up the mess Trump left behind in 2021. Partly because of how different the downturn of 2021 was from 2009 and partly because Biden learned not to drag out a recovery in a way that would leave millions more unemployed, this recovery is much more rapid than the one after the Great Recession. Sadly, Biden now has experience twice helping to facilitate a dramatic recovery.

The many Americans who love the simple idea of unregulated markets means that we could easily end up with another Bush or Trump in 2025 signing legislation for deregulation and tax relief and veto legislation that regulates markets and makes public investments in the future. Weirdly, the choice between these two paths will have almost nothing to do with past numbers and everything to do with ideology formed earlier in life. There’s not much evidence that evidence changes minds, even half a century of evidence.