Vox has a fascinating tool to assess what the four major candidates' tax plans will mean for your household. You can find it

here. The differences are huge.

To illustrate, here is what it generates for a household with a married couple and one child making $50,000 a year. (Not arbitrarily chosen, roughly $50,000 is the median household income in the US.) Under current tax laws, this would mean taxes of about $10,000 a year. (This $10,000 includes federal taxes and payroll taxes like social security, medicare, and unemployment.)

Donald Trump's plan will let you keep an extra $3,210 (or $268 a month) and Ted Cruz will let you keep another $1,800 a year (or $150 a month).

Hillary Clinton will ask you to pay $30 more (or $3 a month) and Bernie Sanders will ask you to pay another $6,820 a year (or $568 a month).

What do you give up or get under these plans? Well, Donald doesn't have a plan to change government programs much, so the government you get will be about the same (even if more xenophobic and misogynic). Cruz will give you less government with his plan to cut programs (but not enough to completely offset the loss in tax revenue). Hillary won't change total spending much and Bernie will - of course - make government programs considerably more generous.

If we were talking housing, here is what the candidates would be proposing.

Trump: Let me slash your monthly mortgage payments! You can stay in the same house, with the same number of bedrooms and maybe even a few new cool appliances and pay $268

less each month. And it'll be a gated community. We won't let

them in.

You: How does that work?

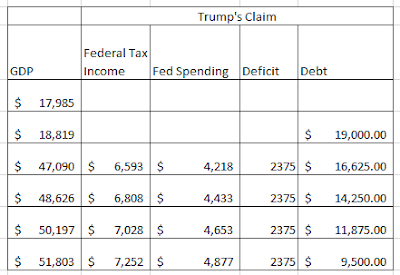

Trump: Well, there will be a little balloon payment of about $30,000 to $40,000 in 8 years but I won't be president then. Plus I can get you a deal. I mean, such a deal on the interest rates. It'll be like you're paying nothing. You are going to wish you had such a deal before. Just save a little each month to prepare for the balloon payment.

You: You mean I should save each month as much as you are lowering my mortgage payment?

Trump: That wouldn't be a bad idea.

You: Oh, and this gated community. Will my old college roommate still be able to visit?

Trump: Not if he's Muslim.

Cruz: I can cut your monthly mortgage payments. By $150 a month. Now, you will have to move from your 3-bedroom house to a 2-bedroom condo, and you'll have to take on more debt but only if that second job doesn't work out.

You: Is the place nice?

Cruz: The new place is adequate. It's not as nice but you've been kidding yourself. You can't afford your current place.

You: But where will my mother sleep when she comes to visit?

Cruz: Your child can sleep on the couch. Or get her own place. It's good to teach self-reliance.

You: She's only 13.

Clinton: You can stay here but you'll have to pay a little more each month to finance your new appliances.

You: Well, that old fridge is making a strange noise. We won't have to move?

Clinton: It turns out, given your salary, this is a pretty good neighborhood.

You: How much more will it cost?

Clinton: About the same as a cup of coffee: $3 a month.

You: So you are saying that not much will change?

Clinton: It will be a huge change. You will have a woman president.

Sanders: Your new place is going to be wonderful! You'll finally have a walk-in pantry like you've always wanted, a home office with a great computer that will make you more productive, and a home entertainment center. With really great speakers.

You: Is this going to cost me?

Sanders: Yeah. It'll be $500 to $600 a month extra. But this is the great place that you deserve to live in.

You: It sounds wonderful but given I won't be making any more, won't that cut into my budget for things like dining out or vacation?

Sanders: You eat junk when you dine out. Not eating out so much will save you in the long run, make you healthier and thinner. Plus, with this new home office you might just generate more income. But even so, why would you want to go anywhere else? This house is going to be so great that you'll be happy just to stay at home.

You: So, it's a great place but I'll be riding the bus because I'm not going to have money for a car payment, will I?

Sanders: Didn't I mention? We will have new buses. Great buses. Finally, mass transit that works! Or you could walk to work. That will also help with your waistline.

Metaphorically, this is what the candidates are offering:

- Smaller payments and much more debt for the same place in a gated community (Trump)

- Smaller payments and more debt for a smaller place (Cruz)

- The same payments and same place (Clinton)

- A nicer, bigger place with much bigger monthly payments (Sanders)

So what will you have?