2016

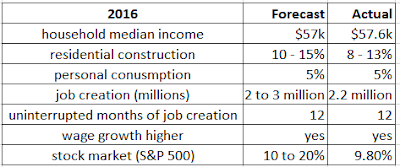

I forecast that median household income would finally enjoy a strong rise and forecast it would hit $55, maybe $57k. It hit $57.7k.

I thought residential construction would rise between 10 to 15%; the monthly year over year rise varied from 8 to 13%.

I forecast a rise in personal consumption of 5%. It hit 5%.

I was bullish on job creation, predicting another 12 straight months of uninterrupted job gains that would total between 2 to 3 million. We got 12 moths of uninterrupted job gains and 2.2 million new jobs.

I forecast a rise in the rate at which wages would go up; they did rise more rapidly in 2016 than they did in 2015.

Finally, I forecast an S&P 500 rise of 10% to 20%. The market rose 9.8%.

2017

Last year, I forecast a smaller number of statistics but predicted a very strong economy. (Prediction is here, A Stimulus, a Boom and White Men Dancing: an economic forecast to the end of the decade )

The forecast starts with:

"First of all, the economy is primed for take-off."

"First of all, the economy is primed for take-off."

And then,

"The next four years will be great and it's perfectly plausible that unemployment will drop below 4% within two to three years. We might even see the uninterrupted run of positive job creation run out another four years, as absurd as that sounds."

Then, it adjusts for the just elected Trump.

"Short term, Trump changes this for the positive ... bump GDP growth .... driving stock prices up."

I tweeted out just two statistics:

Job creation of 2 million and unemployment just over 4%.

The actual numbers? With a month left we're 84,000 jobs short of 2 million and the unemployment rate is 4.1%. Also, the stock market is up 18.8% for the year with weeks to go.

Next post will be my forecast for 2018.

No comments:

Post a Comment