As we were coming out of the Great Recession, people continued to fixate on threats. When you've been beaten you flinch even when someone raises a hand to wave at you, so this makes sense. The Great Recession was awful and it left people anxious about what might happen next. I've reported it before but it bears repeating: in the decades before and after, the economy created an average of 2 million new jobs each year: in the oughts, from 2000 to 2009, the economy did not create jobs but rather destroyed an average of 100,000 jobs per year.

Just consider what a shortfall of 23 million jobs in a decade means for a moment.

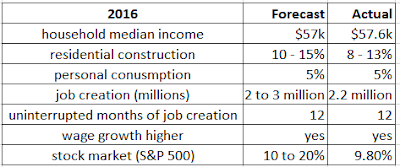

In light of that, it only makes sense that early in this decade people were so aware of what all could go wrong that they lost track of what all could go right. I was cautiously but unrelentingly optimistic about the economy throughout the recovery and it has gone well; now the unemployment rate could soon fall below 4% and the S and P 500 is up nearly 4X (well, 3.6X) what it was when the market bottomed out in early 2009. Even last year, after the election of Trump, I put aside my disbelief and repugnance in his presidency to predict that he would likely preside over another great year for the economy.

Now, for the first time since the end of the Great Recession, I'm pessimistic about the economy. It seems as though that 8 years of good have distracted people from the fact that bad things, too, can hit. Just as 7 years ago most people seemed skeptical that things can go well, most people now seem skeptical that things can blow up.

PERCEPTION AND POLICY

One thing that I've learned is that people mostly don't distinguish between the state of conditions (e.g., we have high or low unemployment), the rate of change in conditions (e.g., the unemployment rate is dropping) or the rate of change in the rate of change (e.g., the economy is still creating jobs but at a slower rate). Obama took office as the Great Recession was at its worst and to this day many people associate him with that state of terrible unemployment. Trump took office when the economy was mostly recovered and many people now associate him with that state of wonderful employment. I do believe that policy makes a difference but the most obvious complicating factors are simply this: it takes time to get policy passed, it takes even more time for that policy to impact the economy, and easily the clearest instance of when policy makes a difference is during a recession. Simply put, there are a variety of theories about how policy changes long-term economic conditions but the causation lag is long and filled with uncertainty. (For instance, most people would agree that early childhood education and wellness programs are positive but assuming those are targeted at kids under 7, it'll be half a century before those children reach their peak earning years and any number of complicating factors - from wars to the popularization of computers or robots - could exacerbate or mitigate the impact of this early childhood intervention. In any case, it's safe to assume that the president and members of congress who instigated such policy would be dead by then and most people will have forgotten them and their policies.)

And a further complication is that about two-thirds of Republicans and a third of Democrats can't see the good when the other party has the White House.

WHAT IS POSITIVE

Debt levels in the US are relatively low; as a

percentage of GDP, federal debt is up about ten percentage points, corporate debt is up about six percentage points and household debt is actually down about five percentage points in the last 5 years, making for a net change of about 11 percentage points. With less reason to pay down debt in 2018, households, corporations and even the government have reason to continue with - and potentially even increase - current levels of spending. This should have a positive impact on future spending.

Unemployment is 4.1% and has now been below 5% for two years. The impact of sustained low levels of unemployment not only include the fore-mentioned debt pay down but great increases in net worth. One of the most extraordinary statistics from the recovery?

The net worth of households is up $42 trillion since the depth of the Great Recession and up $30 trillion from its pre-recession peak in 2Q 2007. When people are collecting regular paychecks they're able to save and invest in homes and stocks. This, too, is promising for 2018.

Further, as unemployment stays low companies have to offer higher wages to attract workers. Wages are growing. As an anecdote, at Thanksgiving we were with three young women all in their early thirties; within the prior four months all three had accepted new positions (two at new employers) for raises ranging from about 15% to 100%. This is the kind of thing that happens when unemployment threatens to drop below 4%.

Further, the Republican tax plan looks to be front-loaded in its impact. Some indications are that it will stimulate the economy the most in 2018 and then slightly less in each of the next few years. It has the potential to add another one percentage point to GDP growth in 2018; that impact is huge.

Finally, the popularization of entrepreneurship - the essence of my book

The Fourth Economy - is continuing. Economic policy at the regional level is increasingly focused on entrepreneurship programs within universities and emulating Silicon Valley's success. (None of that will be easy but even mediocre efforts at things that matter a great deal pay off more than extraordinary effort on things that matter little.)

This is all great news and the most likely thing is that it will translate into another great year.

There is about a 67% chance that the stock market will again rise by double-digits, unemployment will drop below - and stay below - 4%, and wages will rise faster than they have all century. 2018 could be one of the best years since the late 1990s and will likely start out that way. Among other things, this would mean a rise in household income at every level, including median and lower-income and not just those in the top 1 to 20%.

WHAT IS WORRISOME

There is about a 33% chance that the economy turns down in 2018. That turn would probably start some time between May and October.

There are a few reasons that it may turn down: China, a new Federal Reserve Chairman and monetary policy, Trump, and the nature of business cycles.

BUSINESS CYCLES

There are two common measures for these cycles: unemployment rates and the stock market. Sometimes an economy is creating jobs and wealth and sometimes it is destroying them. Since 1900, the US has had 23 recessions, including the Great Depression that began in 1929 and the Great Recession that began in 2008. The length of those downturns has varied from 6 months (the shortest period of downturn that can qualify as a recession) to 43 months (the Great Depression in the early 1930s).

If you were plunked down into a random month between January 1900 and December of 2017, the odds that you'd land in a month in which the economy is suffering from a recession is roughly 24%. Of course Keynesian economics made great advances in the aftermath of the Great Depression and since then the odds of any given month being in recession are 14%. (In the 33 years leading up to the end of the Great Depression, the odds of you landing in a recession plagued month were 48%.)

Curiously, the odds that you would have a month since 1948 in which the unemployment rate is as low - or lower - than it is now is 15%, nearly identical to the odds that you'd be in a recession. The odds that the unemployment rate is 4.1% or lower is the same as the odds that it is 7.4% or higher. (Which is to say that most - about 70% - of the time the unemployment rate bounces around between it's current rate of 4.1% and 7.4%.)

Why does the economy rise and fall? It's because good optimism eventually becomes bad optimism. The economy is bad and someone is optimistic enough to start a business that depends on rising sales. Their optimistic bet pays off, they get rich, and that optimism fuels more optimism. More businesses are started, more stocks bought, more employees hired ... and the economy expands. There comes a day, though, when the optimism is unfounded. New businesses fail at a little faster rate, old businesses expand more slowly or even contract, and the economy begins to destroy jobs and wealth. Now, pessimism is the wise bet and companies layoff and investors hold onto their money. In a bust the pessimists become the leaders. Until the cycle starts anew, as it has a dozen times since the end of the Great Depression in 1933. The booms help to create new things and the busts help to destroy the old; between them job and product markets transform over time, and what we buy and what we do for a living radically changes over a lifetime.

Why mention this? Well, if we're just betting on probabilities - putting aside reasons for optimism mentioned above - there is an 85% chance that unemployment goes up from 4.1% and only a 15% chance that it goes down from there. This claim is less scientific than simply based on data since 1948. Again, the unemployment rate of 4.1% or lower occurs only about 15% of the time. The next month we draw out of the hat is more likely to be higher than lower. Let me be clear: many of the fundamentals suggest that the economy will continue to do well in 2018; that said, economies do not expand without interruption and the odds that it will falter, that unemployment will tick up, are never zero.

Similar for stock prices. Since 2000, stock prices have fallen in five years, or 29% of the time.

ANOTHER REASON TO WORRY? TRUMP

Worst case, his stupid ideas become bad policy. It's not clear that anyone in the Republican Party will resist him and he has at least another year to run with a Republican led House and Senate. If he signs legislation that leads to the deportation of millions of illegal aliens, we'll have a recession. If he manages to jettison NAFTA, we'll have a recession. If he cuts funding for research, per capita GDP growth will slow and the steady increase in life expectancy that we've enjoyed for more than a century could stall.

And of course the Mueller investigation could result in a number of Trump's administration - even Trump himself - facing charges that could force his resignation or even imprisonment. While the final resolution - him in jail or remaining in the White House with Mueller's investigation finally concluded - could stabilize or even rally markets, it's hard to imagine that in the space between when Mueller makes his big reveal and when there is a resolution won't be a time that rocks markets.

In the 10 months before Nixon resigned in the aftermath of the Watergate scandal, the S and P 500 fell 43%.

NEW FEDERAL RESERVE CHAIRMAN JEROME POWELL

Janet Yellen's replacement as head of the Fed (he'll take over in February) is Jerome Powell. I have two big concerns with him: he has no degree in economics and he will be responsible for tightening monetary policy, a delicate operation that can frighten markets.

Work experience - Powell has served in the Fed for years - helps a great deal when it is business as usual. Theory, though, is essential when things change and unlike Yellen and Bernanke who had studied, researched and published on the topics of recessions and recoveries, Powell has never published anything that would suggest he has thought deeply about these topics. The last Fed Chairman to lack an economics degree served in the 1970s but this disregard for expertise is, of course, characteristic of Trump.

The Fed has announced that it will raise interest rates. If it does this too quickly, it slows down the recovery. If it does this too slowly it fuels an asset bubble and / or inflation. Simply put, money pumped into the system helps encourage "real" economic activity (actual investment, consumer borrowing, and hiring) but also drives up prices. People have argued that since the emergence of the World Trade Organization, it is harder for that money to drive up the price of goods that can be imported but instead drives up the prices of assets like stocks and homes. They argue that loose monetary policy is less likely to drive up the price of apples than it is to drive up the price of Apple stock.

Before the Great Recession, excess reserves in American banks ranged from about $1.5 to $3 billion. As the Fed pumped more money into the economy to counter the credit crash, excess reserves rose to $2.9 trillion, roughly 1,000X more. Yellen has quietly lowered that to $2.3 trillion but there is still a lot of money to pull out of the system. Related, the Fed is finally moving interest rates back up, something that will have a ripple effect on lending and all the hiring, expansion, and spending that accompanies low interest rates.

Unwinding loose monetary policy is somewhat like the game of operation, an attempt to remove something without setting off buzzers that suddenly send markets down or - worst case - cause a contraction in credit and a stutter in hiring or consumer spending. I simply trust a lawyer less than I do academics who have studied these matters extensively. I'd be much more comfortable with Yellen serving another term (as the men have for decades back) than I am with Powell learning this new position during a sensitive time in the transition of monetary policy. He's a risk.

AND FINALLY, CHINA

Ruchir Sharma has been worried about a global recession emanating from China for a year or two. He has a couple of plausible concerns, chief among them the amount of debt China has recently created.

Sharma cites thirty instances in which private debt over a 5-year period grew faster than GDP by at least 40 points. (Imagine in year 0 that a country's private debt is equal to 100% of of GDP and in year 5 it is equal to 140%.) In each of these cases, GDP growth fell by more than half over the next five years, occasionally slipping into recession. [See page 300-1 of Sharma's The Rise and Fall of Nations] Sharma is worried about China because over the last five years private sector debt as a percentage of GDP has gone up 56.5 points. It could be that China will escape a downturn as it pays down debt but, again, 30 of 30 countries have been caught in the consequences of rapidly growing debt.

His other concern has to do with a belief in the way business cycles purge the old and create the new. As mentioned, since the US has become the major economy in roughly 1900, it has had 23 recessions. By contrast, in the quarter century since China has begun its great ascent it has had 0 recessions. None. This is a long time to go without market correction.

My own concern with China has to do with my belief in the progress that communities make through four economies: agricultural, industrial, information and entrepreneurial. China - in my opinion - has successfully made the transition from agricultural to industrial economy. Its per capita GDP is now about $10,000, which is one mark for the transition to a new economy. Curiously, President Xi has recently assumed more power than any leader since Mao and is making sounds of a crackdown on dissent. It seems plausible to create an industrial economy coincident with tight government controls; it does not seem plausible to do that with the emergence of an information economy. Simply put, I'm dubious about the compatibility of government control and the emergence of an information economy reliant on knowledge workers who have easy access to information technology and - obviously - information. I don't know how you create an information economy while limiting access to information.

China has not only emerged as the second biggest economy in the globe but it has accounted for a huge portion of global GDP growth over the last quarter of a century. If it falters, it will have a ripple effect.