I just finished Seth Stephens-Davidowitz's fascinating book, Everybody Lies. One of the ideas behind this is that we are more likely to reveal ourselves in private searches than we are in social media posts. Interestingly, there is data on what Americans look for when they search and thus, data on who we are.

One of the things he shares is words that predict whether someone is more or less likely to pay back a loan. A website prosper lets people offer a story about why they need a loan and folks reading this can decide whether or not to loan them money. Three economists analyzed the stories and tried to identify which words would be a leading indicator of who would pay back loans and who would default. (About 13% of people who borrow do default, never paying back the loan.) This is what they found.

Terms used in loan applications by people most likely to pay back:

debt-free, after-tax, graduate, lower interest rate, minimum payment

Terms used in loan applications by people most likely to default:

God, promise, will pay, hospital, thank you

As it turns out, people who are dealing with reality are more likely to pay back. These people are talking about real issues, like after-tax income, or minimum payments. It also makes sense that someone mentioning when they might graduate would be a good risk; this person should soon see a drop in tuition and - hopefully - a rise in salary. Their situation is about to change for the better and it makes sense that they would be in better position tomorrow than they are today; they're a good risk.

Meanwhile, people who offer only their word (promise or will pay) aren't forecasting any change in their future situation and thus there is little reason to believe that they'll soon go from needing money to having extra money and being able to pay you back. Hospital, too, suggests why they would need money now but really offers no reason why they'd have more money in the future. (The mention of something as expensive as hospital is an argument for healthcare, not a loan.) Finally, there is good reason why mention of God should be a red flag.

People who mention God in their requests for loans are 2.2X more likely to default than the average person. This is the highest-risk word and it makes perfect sense why that would be.

Only two people would mention God in regards to a loan: people who think he cares about their financial situation and people who are trying to con the religious.

People who think that God cares about their finances cannot, of course, explain why God would first get cash to someone in a first-world country before he would a small child in a third-world country. It's a ludicrous idea on so many fronts and the God who would care that you got a new car that let you stop riding the bus while a child in a refugee camp goes without education is an odd God. Further, these people are not dealing with reality. They're not talking about or thinking about minimum payments or graduation. They are waiting for God to intervene in their finances. That's not likely to happen.

The other folks who would invoke God when asking for money are running a con. Religious people are conscientious and easier to manipulate once you've reminded them of their faith. The mention of God by these con men is done because it is a more effective way to get your money. If they thought that mention of the San Diego Padres was more likely to prompt you to give them money, they'd wax eloquent about the Padres.

The same arguments hold for someone asking for your vote rather than a loan. Anyone who invokes God is either hoping that God will intervene in policy matters or running a con on voters who believe that. Given a choice between a plumber who has training and experience and one who believes the support of the evangelical community will make him successful when he crawls under your kitchen sink for the first time, I'll go with the plumber who has demonstrable skills and - regardless of what God or afterlife he believes in - believes that natural consequences comes from natural - not supernatural - intervention. I'd rather have a plumber with a good wrench than one with a great prayer. And I don't see any evidence that policy is any different.

If someone mentions God when asking for a loan or asking for your vote, just say no. Instead, ask them how they are going to deal with reality. If they are making $1,500 a month now and need a loan for $500, what is going to change in a month when they begin paying back the loan that makes me think they'll have an extra $100 a month rather than be running short by $100 a month? God is not the right answer.

The question of any politician is not whether he thinks God likes him better than his opponent. The question of the guy who wants your vote is no different than the question of the guy who wants a loan: how are you going to deal with reality, making the rash assumption that no miracle will save you?

29 December 2017

23 December 2017

Trying to Make Sense of Why Republicans Can't Make Sense of Deficits

It's not clear whether Republicans have given up on caring about the economy or if their ideology blinds them to what even sharp high school students can see. What I do know is that a horde of friends who - presumably fed by Fox news or other conservative news outlets - were loudly fretting about deficits during the recovery are now mum about the deficits that will follow from Trump's new tax cut.

One of the simplest things we know about economies is that when unemployment is high you should increase the size of deficits and when unemployment is low you should lower the size of deficits. This is so obvious that it hardly merits mention and yet Republicans seem to miss this point. I don't know if it is because of a paradigm filter, crass disregard for the larger economy, or simple opportunism that comes from disregarding any goals but tax cuts.

Deficits stimulate the economy. That said, there are deficits that are good stimulants and deficits that are poor. The best deficit comes from spending money on things like infrastructure that will leave an economy more able to grow. Ideally, a deficit stimulates the economy short term and lays the foundation for higher productivity in the future. The worst deficit just adds more money to wealthy people who are unlikely to spend much of it. (If your net worth is $3 million and you get another $10,000 in tax cuts, you are less likely to spend any of that money than someone whose net worth is $10,000.) Good or bad, a deficit stimulates the economy, although to different degrees.

As trade makes up a bigger part of the economy, deficit spending it more likely to drive up asset prices like stocks and homes; rather than see a rise in the price of apples, you might see a rise in the price of Apple stock.

(Yes there are other factors. No I'm not going to cover those here.)

Why does this matter? Well, you can't just say that it is good or bad to increase the size of a deficit. If you suffer from high unemployment, increasing deficits is great; if you are enjoying low unemployment, increasing deficits is bad. Atop that, deficits that build the economy's capacity (borrowing to invest in building freeways or high speed rails or basic research or education initiatives) are better than deficits that just create a temporary blip in spending (e.g., tax cuts).

The year before George W. Bush took office, unemployment averaged 4%, its lowest since 1969. It seems safe to say that the economy was at full employment. What did George W. Bush do once he took office? He cut taxes to stimulate the economy. What happened? The price of homes - assets - and the mortgage back securities that financed their purchase went up. Spectacularly. This stimulus created a bubble and bubbles burst. The year before Bush took office unemployment averaged 4% and the year after he was in office it averaged 9.3%. Stimulating an already strong economy turned out to be disastrous.

The first year of Trump's presidency, unemployment will average 4.4%, its lowest since Clinton's last year in office. What does Trump do? He is cutting taxes to stimulate the economy. This could feed a bubble in asset prices ... a bubble that will pop more spectacularly than it otherwise would have. Stimulating a weak economy can create a strong one; stimulating a strong economy can create a bubble.

The Republicans who hollered about deficits during the Great Recession are now creating a deficit in a time of full employment.

It seems as though Republicans like deficits in good times and hate them in bad times.

The question is, why? This is not a difficult concept to grasp and yet Republicans refuse it.

I can only think of a few reasons.

One, they want tax cuts more than they want a healthy economy. They really do think it's possible to live like the rich in banana republics, comfortable even when the larger economy is bad, and as long as they get their tax cuts they don't really care about the larger economy.

Two, they don't believe that macroeconomic policy makes any difference, instead believing that individuals make all the difference. (It is true that individuals make a difference; some do well in bad economies and some do badly in good economies. It is not true that recessions hit because the percentage of lazy people in an economy suddenly doubles, because of changes in individual behavior. The strategies to get near the top of a group are different from the strategies to move a group's median income up.)

Three, they can't distinguish between individuals and a community when it comes to who should get a loan. It is true that you don't want to loan to a guy who is out of work and you'd be happy to loan to a guy with a great job. In that sense they are right that deficits are "safer" when the economy is good. But of course debt is very different for an economy than it is for an individual or household. Even a household engages in deficit spending when times are bad and pays down debt when times are good; if you are unemployed you borrow from your savings or friends; if you are fully employed you save. The banker may rather loan to the guy with a job but it is the guy who is temporarily out of work who most needs the loan. It may seem safe to create more debt in the economy when times are good but that stimulates spending that threatens to create bubbles.

What will be the result of the Trump tax cut? The economy will get worse. Not immediately. Immediately it will get better because the start of bubbles are the best part; it's the busting of bubbles that is miserable.

One of the simplest things we know about economies is that when unemployment is high you should increase the size of deficits and when unemployment is low you should lower the size of deficits. This is so obvious that it hardly merits mention and yet Republicans seem to miss this point. I don't know if it is because of a paradigm filter, crass disregard for the larger economy, or simple opportunism that comes from disregarding any goals but tax cuts.

Deficits stimulate the economy. That said, there are deficits that are good stimulants and deficits that are poor. The best deficit comes from spending money on things like infrastructure that will leave an economy more able to grow. Ideally, a deficit stimulates the economy short term and lays the foundation for higher productivity in the future. The worst deficit just adds more money to wealthy people who are unlikely to spend much of it. (If your net worth is $3 million and you get another $10,000 in tax cuts, you are less likely to spend any of that money than someone whose net worth is $10,000.) Good or bad, a deficit stimulates the economy, although to different degrees.

As trade makes up a bigger part of the economy, deficit spending it more likely to drive up asset prices like stocks and homes; rather than see a rise in the price of apples, you might see a rise in the price of Apple stock.

(Yes there are other factors. No I'm not going to cover those here.)

Why does this matter? Well, you can't just say that it is good or bad to increase the size of a deficit. If you suffer from high unemployment, increasing deficits is great; if you are enjoying low unemployment, increasing deficits is bad. Atop that, deficits that build the economy's capacity (borrowing to invest in building freeways or high speed rails or basic research or education initiatives) are better than deficits that just create a temporary blip in spending (e.g., tax cuts).

The year before George W. Bush took office, unemployment averaged 4%, its lowest since 1969. It seems safe to say that the economy was at full employment. What did George W. Bush do once he took office? He cut taxes to stimulate the economy. What happened? The price of homes - assets - and the mortgage back securities that financed their purchase went up. Spectacularly. This stimulus created a bubble and bubbles burst. The year before Bush took office unemployment averaged 4% and the year after he was in office it averaged 9.3%. Stimulating an already strong economy turned out to be disastrous.

The first year of Trump's presidency, unemployment will average 4.4%, its lowest since Clinton's last year in office. What does Trump do? He is cutting taxes to stimulate the economy. This could feed a bubble in asset prices ... a bubble that will pop more spectacularly than it otherwise would have. Stimulating a weak economy can create a strong one; stimulating a strong economy can create a bubble.

The Republicans who hollered about deficits during the Great Recession are now creating a deficit in a time of full employment.

It seems as though Republicans like deficits in good times and hate them in bad times.

The question is, why? This is not a difficult concept to grasp and yet Republicans refuse it.

I can only think of a few reasons.

One, they want tax cuts more than they want a healthy economy. They really do think it's possible to live like the rich in banana republics, comfortable even when the larger economy is bad, and as long as they get their tax cuts they don't really care about the larger economy.

Two, they don't believe that macroeconomic policy makes any difference, instead believing that individuals make all the difference. (It is true that individuals make a difference; some do well in bad economies and some do badly in good economies. It is not true that recessions hit because the percentage of lazy people in an economy suddenly doubles, because of changes in individual behavior. The strategies to get near the top of a group are different from the strategies to move a group's median income up.)

Three, they can't distinguish between individuals and a community when it comes to who should get a loan. It is true that you don't want to loan to a guy who is out of work and you'd be happy to loan to a guy with a great job. In that sense they are right that deficits are "safer" when the economy is good. But of course debt is very different for an economy than it is for an individual or household. Even a household engages in deficit spending when times are bad and pays down debt when times are good; if you are unemployed you borrow from your savings or friends; if you are fully employed you save. The banker may rather loan to the guy with a job but it is the guy who is temporarily out of work who most needs the loan. It may seem safe to create more debt in the economy when times are good but that stimulates spending that threatens to create bubbles.

What will be the result of the Trump tax cut? The economy will get worse. Not immediately. Immediately it will get better because the start of bubbles are the best part; it's the busting of bubbles that is miserable.

19 December 2017

Returns Without Risk - The Republicans Vision of Banking Reform And How It Makes Recessions Worse

Matt Yglesias at Vox reports on the extent to which Republicans are changing laws to profit them and their donors. In the midst of this list he reports on something hugely important.

Banks - or more broadly, the financial system that creates credit - are essential to an economy. If credit markets suddenly collapse, they bring down the economy with them.

Once upon a time, a bank would fail and the folks with deposits in that bank would lose all their money. Folks with money in other banks would panic and make a run on their bank to withdraw deposits. That could quickly put that bank under. And then more people would make a run on their bank to withdraw their money. And on it would go until the economy in that region was destroying jobs and wealth. Bank runs led to recessions.

In the first 33 years of the 20th century - from 1900 to 1933 - the US suffered from a recession 48% of the time. There were 10 recessions between 1900 and 1933 and the final one was such a doozy that it got the label of depression; during it GDP dropped by half and unemployment hit 25%.

After the Great Depression, legislators decided that they would protect depositors in banks so that a bank failing wouldn't automatically bankrupt its depositors. This helped to stop the runs on banks after one bank failed so that one bank's failure did not spread like a virus to take down other banks and communities.

Given the size of banks, it became increasingly difficult to bail out depositors and ignore failing banks. So legislators decided to offer what was essentially insurance to banks - bailout money - in return for those banks following certain rules. For instance, a bank would have to keep on hand a certain number of deposits, follow certain lending guidelines, etc. The government would protect the banking system and in return the banks would follow certain rules that lowered returns but also lowered risk.

Before the regulation that came in the wake of the Great Depression, the US was in recession half the time. 48%. After the regulations, it was in recession only 14% of the time. Then the Bush Cheney administration deregulated - lifting the rules that banks complained were too restrictive - and within just a few years the country plunged into the worst recession since the Great Depression. Banks got their higher returns. They also created more risk to the entire economy.

Dodd-Frank put back in place some regulations and quite simply reached the same conclusion the country reached after the Great Depression: a community cannot afford to let the financial system collapse so it will offer a combination of rules that keep banks out of trouble and insurance to keep the larger economy out of trouble. We will bail out banks but they have to follow certain rules that make that bail out less likely.

At the time, some Republicans said that this was ridiculous. Banks should be treated like any other business and simply allowed to fail, arguing that all those rules only inhibit smart bankers from making money. Let banks do what they want and let them fail if that turned out badly, these Republicans said. They were, essentially, asking for a return to how things were regulated before the Great Depression, the world that plunged the country into recessions about half the time.

Now the Republicans have full control of government. What have they chosen? Deregulation that allows banks to act more freely, even if that adds risk. Oh, and they've left in place the bailout money. What does that mean? Banks are more likely to take risks that raise returns and we the taxpayers get to bail them out.

One of the few certainties in finance is the link between risk and returns. The investments that offer the most return offer the most risk (think junk bonds or stock in a startup) and the investments that offer the least risk offer the least return (think bank savings account). The Republicans are now moving us closer to a world in which banks get the returns and we get the risk.

Banks are essential to a modern economy. They can be regulated by market success or failures, although that can plunge an economy into recession half the time. Or they can be regulated by government rules, something that cuts the odds of recession to about one quarter of what they would otherwise be but puts the taxpayer on the hook for bailouts. Or, as the Trump administration has chosen to do, they can be freed of market consequence with the promise of bailout money AND free of the regulation of government rules. Thanks to the 2017 GOP, banks will be able to operate without the discipline of regulators or markets.

Let's be clear. With these rules, the rational strategy for bankers will be to take excess risk (and the excess returns that - at least temporarily - come with it). This type of legislation is guaranteed to trigger recessions more frequently and more severely. It makes the banking system more vulnerable and taxpayers liable twice: they'll suffer from the layoffs and drop in value of their pensions and 401(k) accounts when recessions hit with more severity and they will pay for the bailout of these banks.

I bet that works out well.

Banks - or more broadly, the financial system that creates credit - are essential to an economy. If credit markets suddenly collapse, they bring down the economy with them.

Once upon a time, a bank would fail and the folks with deposits in that bank would lose all their money. Folks with money in other banks would panic and make a run on their bank to withdraw deposits. That could quickly put that bank under. And then more people would make a run on their bank to withdraw their money. And on it would go until the economy in that region was destroying jobs and wealth. Bank runs led to recessions.

In the first 33 years of the 20th century - from 1900 to 1933 - the US suffered from a recession 48% of the time. There were 10 recessions between 1900 and 1933 and the final one was such a doozy that it got the label of depression; during it GDP dropped by half and unemployment hit 25%.

After the Great Depression, legislators decided that they would protect depositors in banks so that a bank failing wouldn't automatically bankrupt its depositors. This helped to stop the runs on banks after one bank failed so that one bank's failure did not spread like a virus to take down other banks and communities.

Given the size of banks, it became increasingly difficult to bail out depositors and ignore failing banks. So legislators decided to offer what was essentially insurance to banks - bailout money - in return for those banks following certain rules. For instance, a bank would have to keep on hand a certain number of deposits, follow certain lending guidelines, etc. The government would protect the banking system and in return the banks would follow certain rules that lowered returns but also lowered risk.

Before the regulation that came in the wake of the Great Depression, the US was in recession half the time. 48%. After the regulations, it was in recession only 14% of the time. Then the Bush Cheney administration deregulated - lifting the rules that banks complained were too restrictive - and within just a few years the country plunged into the worst recession since the Great Depression. Banks got their higher returns. They also created more risk to the entire economy.

Dodd-Frank put back in place some regulations and quite simply reached the same conclusion the country reached after the Great Depression: a community cannot afford to let the financial system collapse so it will offer a combination of rules that keep banks out of trouble and insurance to keep the larger economy out of trouble. We will bail out banks but they have to follow certain rules that make that bail out less likely.

At the time, some Republicans said that this was ridiculous. Banks should be treated like any other business and simply allowed to fail, arguing that all those rules only inhibit smart bankers from making money. Let banks do what they want and let them fail if that turned out badly, these Republicans said. They were, essentially, asking for a return to how things were regulated before the Great Depression, the world that plunged the country into recessions about half the time.

Now the Republicans have full control of government. What have they chosen? Deregulation that allows banks to act more freely, even if that adds risk. Oh, and they've left in place the bailout money. What does that mean? Banks are more likely to take risks that raise returns and we the taxpayers get to bail them out.

One of the few certainties in finance is the link between risk and returns. The investments that offer the most return offer the most risk (think junk bonds or stock in a startup) and the investments that offer the least risk offer the least return (think bank savings account). The Republicans are now moving us closer to a world in which banks get the returns and we get the risk.

Banks are essential to a modern economy. They can be regulated by market success or failures, although that can plunge an economy into recession half the time. Or they can be regulated by government rules, something that cuts the odds of recession to about one quarter of what they would otherwise be but puts the taxpayer on the hook for bailouts. Or, as the Trump administration has chosen to do, they can be freed of market consequence with the promise of bailout money AND free of the regulation of government rules. Thanks to the 2017 GOP, banks will be able to operate without the discipline of regulators or markets.

Let's be clear. With these rules, the rational strategy for bankers will be to take excess risk (and the excess returns that - at least temporarily - come with it). This type of legislation is guaranteed to trigger recessions more frequently and more severely. It makes the banking system more vulnerable and taxpayers liable twice: they'll suffer from the layoffs and drop in value of their pensions and 401(k) accounts when recessions hit with more severity and they will pay for the bailout of these banks.

I bet that works out well.

18 December 2017

Ron's Economic Forecast for 2018 - Highest Probability of a Recession in 8 Years

A Chinese recession? A bumbling Fed Chair? A downturn in stocks? Your blogger predicts a 33% chance of bad news for the American economy in 2018.

As we were coming out of the Great Recession, people continued to fixate on threats. When you've been beaten you flinch even when someone raises a hand to wave at you, so this makes sense. The Great Recession was awful and it left people anxious about what might happen next. I've reported it before but it bears repeating: in the decades before and after, the economy created an average of 2 million new jobs each year: in the oughts, from 2000 to 2009, the economy did not create jobs but rather destroyed an average of 100,000 jobs per year. Rather than create 22 million jobs, that decade destroyed a million jobs. Just consider what a shortfall of 23 million jobs in a decade means for a moment.

In light of that, it only makes sense that early in this decade people were so aware of what all could go wrong that they lost track of what all could go right. I was cautiously but unrelentingly optimistic about the economy throughout the recovery and it has gone well; now the unemployment rate could soon fall below 4% and the S and P 500 is up nearly 4X (well, 3.6X) what it was when the market bottomed out in early 2009. Even last year, after the election of Trump, I put aside my disbelief and repugnance in his presidency to predict that he would likely preside over another great year for the economy.

Now, for the first time since the end of the Great Recession, I'm pessimistic about the economy. It seems as though that 8 years of good have distracted people from the fact that bad things, too, can hit. Just as 7 years ago most people seemed skeptical that things can go well, most people now seem skeptical that things can blow up.

PERCEPTION AND POLICY

One thing that I've learned is that people mostly don't distinguish between the state of conditions (e.g., we have high or low unemployment), the rate of change in conditions (e.g., the unemployment rate is dropping) or the rate of change in the rate of change (e.g., the economy is still creating jobs but at a slower rate). Obama took office as the Great Recession was at its worst and to this day many people associate him with that state of terrible unemployment. Trump took office when the economy was mostly recovered and many people now associate him with that state of wonderful employment. I do believe that policy makes a difference but the most obvious complicating factors are simply this: it takes time to get policy passed, it takes even more time for that policy to impact the economy, and easily the clearest instance of when policy makes a difference is during a recession. Simply put, there are a variety of theories about how policy changes long-term economic conditions but the causation lag is long and filled with uncertainty. (For instance, most people would agree that early childhood education and wellness programs are positive but assuming those are targeted at kids under 7, it'll be half a century before those children reach their peak earning years and any number of complicating factors - from wars to the popularization of computers or robots - could exacerbate or mitigate the impact of this early childhood intervention. In any case, it's safe to assume that the president and members of congress who instigated such policy would be dead by then and most people will have forgotten them and their policies.)

And a further complication is that about two-thirds of Republicans and a third of Democrats can't see the good when the other party has the White House.

WHAT IS POSITIVE

Debt levels in the US are relatively low; as a percentage of GDP, federal debt is up about ten percentage points, corporate debt is up about six percentage points and household debt is actually down about five percentage points in the last 5 years, making for a net change of about 11 percentage points. With less reason to pay down debt in 2018, households, corporations and even the government have reason to continue with - and potentially even increase - current levels of spending. This should have a positive impact on future spending.

Unemployment is 4.1% and has now been below 5% for two years. The impact of sustained low levels of unemployment not only include the fore-mentioned debt pay down but great increases in net worth. One of the most extraordinary statistics from the recovery? The net worth of households is up $42 trillion since the depth of the Great Recession and up $30 trillion from its pre-recession peak in 2Q 2007. When people are collecting regular paychecks they're able to save and invest in homes and stocks. This, too, is promising for 2018.

Further, as unemployment stays low companies have to offer higher wages to attract workers. Wages are growing. As an anecdote, at Thanksgiving we were with three young women all in their early thirties; within the prior four months all three had accepted new positions (two at new employers) for raises ranging from about 15% to 100%. This is the kind of thing that happens when unemployment threatens to drop below 4%.

Further, the Republican tax plan looks to be front-loaded in its impact. Some indications are that it will stimulate the economy the most in 2018 and then slightly less in each of the next few years. It has the potential to add another one percentage point to GDP growth in 2018; that impact is huge.

Finally, the popularization of entrepreneurship - the essence of my book The Fourth Economy - is continuing. Economic policy at the regional level is increasingly focused on entrepreneurship programs within universities and emulating Silicon Valley's success. (None of that will be easy but even mediocre efforts at things that matter a great deal pay off more than extraordinary effort on things that matter little.)

This is all great news and the most likely thing is that it will translate into another great year.

There is about a 67% chance that the stock market will again rise by double-digits, unemployment will drop below - and stay below - 4%, and wages will rise faster than they have all century. 2018 could be one of the best years since the late 1990s and will likely start out that way. Among other things, this would mean a rise in household income at every level, including median and lower-income and not just those in the top 1 to 20%.

WHAT IS WORRISOME

There is about a 33% chance that the economy turns down in 2018. That turn would probably start some time between May and October.

There are a few reasons that it may turn down: China, a new Federal Reserve Chairman and monetary policy, Trump, and the nature of business cycles.

BUSINESS CYCLES

There are two common measures for these cycles: unemployment rates and the stock market. Sometimes an economy is creating jobs and wealth and sometimes it is destroying them. Since 1900, the US has had 23 recessions, including the Great Depression that began in 1929 and the Great Recession that began in 2008. The length of those downturns has varied from 6 months (the shortest period of downturn that can qualify as a recession) to 43 months (the Great Depression in the early 1930s).

If you were plunked down into a random month between January 1900 and December of 2017, the odds that you'd land in a month in which the economy is suffering from a recession is roughly 24%. Of course Keynesian economics made great advances in the aftermath of the Great Depression and since then the odds of any given month being in recession are 14%. (In the 33 years leading up to the end of the Great Depression, the odds of you landing in a recession plagued month were 48%.)

Curiously, the odds that you would have a month since 1948 in which the unemployment rate is as low - or lower - than it is now is 15%, nearly identical to the odds that you'd be in a recession. The odds that the unemployment rate is 4.1% or lower is the same as the odds that it is 7.4% or higher. (Which is to say that most - about 70% - of the time the unemployment rate bounces around between it's current rate of 4.1% and 7.4%.)

Why does the economy rise and fall? It's because good optimism eventually becomes bad optimism. The economy is bad and someone is optimistic enough to start a business that depends on rising sales. Their optimistic bet pays off, they get rich, and that optimism fuels more optimism. More businesses are started, more stocks bought, more employees hired ... and the economy expands. There comes a day, though, when the optimism is unfounded. New businesses fail at a little faster rate, old businesses expand more slowly or even contract, and the economy begins to destroy jobs and wealth. Now, pessimism is the wise bet and companies layoff and investors hold onto their money. In a bust the pessimists become the leaders. Until the cycle starts anew, as it has a dozen times since the end of the Great Depression in 1933. The booms help to create new things and the busts help to destroy the old; between them job and product markets transform over time, and what we buy and what we do for a living radically changes over a lifetime.

Why mention this? Well, if we're just betting on probabilities - putting aside reasons for optimism mentioned above - there is an 85% chance that unemployment goes up from 4.1% and only a 15% chance that it goes down from there. This claim is less scientific than simply based on data since 1948. Again, the unemployment rate of 4.1% or lower occurs only about 15% of the time. The next month we draw out of the hat is more likely to be higher than lower. Let me be clear: many of the fundamentals suggest that the economy will continue to do well in 2018; that said, economies do not expand without interruption and the odds that it will falter, that unemployment will tick up, are never zero.

Similar for stock prices. Since 2000, stock prices have fallen in five years, or 29% of the time.

ANOTHER REASON TO WORRY? TRUMP

Worst case, his stupid ideas become bad policy. It's not clear that anyone in the Republican Party will resist him and he has at least another year to run with a Republican led House and Senate. If he signs legislation that leads to the deportation of millions of illegal aliens, we'll have a recession. If he manages to jettison NAFTA, we'll have a recession. If he cuts funding for research, per capita GDP growth will slow and the steady increase in life expectancy that we've enjoyed for more than a century could stall.

And of course the Mueller investigation could result in a number of Trump's administration - even Trump himself - facing charges that could force his resignation or even imprisonment. While the final resolution - him in jail or remaining in the White House with Mueller's investigation finally concluded - could stabilize or even rally markets, it's hard to imagine that in the space between when Mueller makes his big reveal and when there is a resolution won't be a time that rocks markets.

In the 10 months before Nixon resigned in the aftermath of the Watergate scandal, the S and P 500 fell 43%.

In the 10 months before Nixon resigned in the aftermath of the Watergate scandal, the S and P 500 fell 43%.

NEW FEDERAL RESERVE CHAIRMAN JEROME POWELL

Janet Yellen's replacement as head of the Fed (he'll take over in February) is Jerome Powell. I have two big concerns with him: he has no degree in economics and he will be responsible for tightening monetary policy, a delicate operation that can frighten markets.

Work experience - Powell has served in the Fed for years - helps a great deal when it is business as usual. Theory, though, is essential when things change and unlike Yellen and Bernanke who had studied, researched and published on the topics of recessions and recoveries, Powell has never published anything that would suggest he has thought deeply about these topics. The last Fed Chairman to lack an economics degree served in the 1970s but this disregard for expertise is, of course, characteristic of Trump.

The Fed has announced that it will raise interest rates. If it does this too quickly, it slows down the recovery. If it does this too slowly it fuels an asset bubble and / or inflation. Simply put, money pumped into the system helps encourage "real" economic activity (actual investment, consumer borrowing, and hiring) but also drives up prices. People have argued that since the emergence of the World Trade Organization, it is harder for that money to drive up the price of goods that can be imported but instead drives up the prices of assets like stocks and homes. They argue that loose monetary policy is less likely to drive up the price of apples than it is to drive up the price of Apple stock.

Before the Great Recession, excess reserves in American banks ranged from about $1.5 to $3 billion. As the Fed pumped more money into the economy to counter the credit crash, excess reserves rose to $2.9 trillion, roughly 1,000X more. Yellen has quietly lowered that to $2.3 trillion but there is still a lot of money to pull out of the system. Related, the Fed is finally moving interest rates back up, something that will have a ripple effect on lending and all the hiring, expansion, and spending that accompanies low interest rates.

Unwinding loose monetary policy is somewhat like the game of operation, an attempt to remove something without setting off buzzers that suddenly send markets down or - worst case - cause a contraction in credit and a stutter in hiring or consumer spending. I simply trust a lawyer less than I do academics who have studied these matters extensively. I'd be much more comfortable with Yellen serving another term (as the men have for decades back) than I am with Powell learning this new position during a sensitive time in the transition of monetary policy. He's a risk.

AND FINALLY, CHINA

Ruchir Sharma has been worried about a global recession emanating from China for a year or two. He has a couple of plausible concerns, chief among them the amount of debt China has recently created.

Sharma cites thirty instances in which private debt over a 5-year period grew faster than GDP by at least 40 points. (Imagine in year 0 that a country's private debt is equal to 100% of of GDP and in year 5 it is equal to 140%.) In each of these cases, GDP growth fell by more than half over the next five years, occasionally slipping into recession. [See page 300-1 of Sharma's The Rise and Fall of Nations] Sharma is worried about China because over the last five years private sector debt as a percentage of GDP has gone up 56.5 points. It could be that China will escape a downturn as it pays down debt but, again, 30 of 30 countries have been caught in the consequences of rapidly growing debt.

His other concern has to do with a belief in the way business cycles purge the old and create the new. As mentioned, since the US has become the major economy in roughly 1900, it has had 23 recessions. By contrast, in the quarter century since China has begun its great ascent it has had 0 recessions. None. This is a long time to go without market correction.

My own concern with China has to do with my belief in the progress that communities make through four economies: agricultural, industrial, information and entrepreneurial. China - in my opinion - has successfully made the transition from agricultural to industrial economy. Its per capita GDP is now about $10,000, which is one mark for the transition to a new economy. Curiously, President Xi has recently assumed more power than any leader since Mao and is making sounds of a crackdown on dissent. It seems plausible to create an industrial economy coincident with tight government controls; it does not seem plausible to do that with the emergence of an information economy. Simply put, I'm dubious about the compatibility of government control and the emergence of an information economy reliant on knowledge workers who have easy access to information technology and - obviously - information. I don't know how you create an information economy while limiting access to information.

China has not only emerged as the second biggest economy in the globe but it has accounted for a huge portion of global GDP growth over the last quarter of a century. If it falters, it will have a ripple effect.

Finally, things happen that haven't been predicted. The price of mortgage backed securities suddenly falls. Terrorists fly planes into the World Trade Center. I've listed a variety of triggers for a recession but it could easily be something completely unforeseen that is the trigger.

THE FORECAST

For now I'm keeping my money in stocks until the end of the first quarter of 2018. I think the market will rise another 3% to 8% by May and the unemployment rate will go as low as 3.8%. Home construction will rise, as will business investment.

I'm worried, though, that the the market will turn down about mid-year, as will job creation. The market could finish the year down about 5% to 10% and while unemployment will still be decent (4%? 4.5%?) job creation will turn negative for the first time in 8 years. The total number of jobs created in 2018 will be about 1 million, give or take, about half what it has averaged during the recovery.

For the year:

S and P 500: down 5 to 10%

S and P 500: down 5 to 10%

Jobs: up 1 million

Unemployment: Roughly unchanged or up slightly to somewhere between 4.0 to 4.5%

Finally, where we are as of when this was published:

S and P 500 is at 2,692.71

Unemployment is at 4.1%

15 December 2017

Your Blogger's Forecast Record for the Last 2 Years - 2016 and 2017

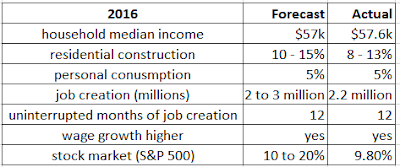

Some years I make forecasts for the coming year. This is a blog so there is nothing standard about what metrics I forecast but here is a recap for the last two years.

2016

I forecast that median household income would finally enjoy a strong rise and forecast it would hit $55, maybe $57k. It hit $57.7k.

I thought residential construction would rise between 10 to 15%; the monthly year over year rise varied from 8 to 13%.

I forecast a rise in personal consumption of 5%. It hit 5%.

I was bullish on job creation, predicting another 12 straight months of uninterrupted job gains that would total between 2 to 3 million. We got 12 moths of uninterrupted job gains and 2.2 million new jobs.

I forecast a rise in the rate at which wages would go up; they did rise more rapidly in 2016 than they did in 2015.

Finally, I forecast an S&P 500 rise of 10% to 20%. The market rose 9.8%.

2017

Last year, I forecast a smaller number of statistics but predicted a very strong economy. (Prediction is here, A Stimulus, a Boom and White Men Dancing: an economic forecast to the end of the decade )

The forecast starts with:

"First of all, the economy is primed for take-off."

"First of all, the economy is primed for take-off."

And then,

"The next four years will be great and it's perfectly plausible that unemployment will drop below 4% within two to three years. We might even see the uninterrupted run of positive job creation run out another four years, as absurd as that sounds."

Then, it adjusts for the just elected Trump.

"Short term, Trump changes this for the positive ... bump GDP growth .... driving stock prices up."

I tweeted out just two statistics:

Job creation of 2 million and unemployment just over 4%.

The actual numbers? With a month left we're 84,000 jobs short of 2 million and the unemployment rate is 4.1%. Also, the stock market is up 18.8% for the year with weeks to go.

Next post will be my forecast for 2018.

04 December 2017

What Our Oldest Story Tells us About What it Means to be Human - Greenblatt on Gilgamesh

All of this is taken from Stephen Greenblatt's new book The Rise and Fall of Adam and Eve. This is a blog post rather than a book chapter, so where I could I made the story much more succinct, the result being that this is more choppy and less informative than Greenblatt's account.

----------------

Gilgamesh was written by Sin-lequi-unninni. All that is known of him is that he probably compiled materials - texts and oral legends - that reached far back into the past.

The Torah was probably assembled in the fifth century BCE; the Iliad somewhat earlier, perhaps between 760 and 710 BCE. But Sin-lequi-unninni wrote his text sometime between 1300 and 1000 BCE, and the earliest surviving written tales of Gilgamesh date from around 2100 BCE. Older by more than a thousand years than either Homer or the Bible, Gilgamesh is quite possibly the oldest story ever found. [And what follows is just a portion of that epic of Gilgamesh.]

The Torah was probably assembled in the fifth century BCE; the Iliad somewhat earlier, perhaps between 760 and 710 BCE. But Sin-lequi-unninni wrote his text sometime between 1300 and 1000 BCE, and the earliest surviving written tales of Gilgamesh date from around 2100 BCE. Older by more than a thousand years than either Homer or the Bible, Gilgamesh is quite possibly the oldest story ever found. [And what follows is just a portion of that epic of Gilgamesh.]

Uruk was the first city in the ancient Near East and perhaps the first city in human history and the creation story of Gilgamesh starts there. This isn't the story of the origin of humans. This is the story of the origination of humanity, told through a being named Enkidu who is transformed from beast to man.

The people of Uruk are terrorized by Gilgamesh who is one-third human and two-thirds god. He's a great builder and warrior but his sexual appetites are terrorizing the city. In response to the complaints about him from the people of Uruk, the gods create Enkidu who is placed - not in the city but - in the wilderness outside the city.

Enkidu roams naked with gazelles, a wild creature with hair covering his whole body. Then he meets Shamhat.

Shamhat is a temple prostitute skilled in all pleasures. Shamhat and Enkidu spend six days and seven nights in fervent lovemaking and at the end of this time, when Enkidu tries to rejoin the gazelles he cannot. This - the love of Shamhat - has changed him. He is no longer an animal.

Shamhat continues Enkidu's initiation. He cleans himself and seems to lose the hair covering his body. He eats at a table. She takes off her clothes and shares them with him (one for me, one for you style), clothing becoming a sign of culture rather than a covering for shame.

Next comes friendship. Enkidu meets Gilgamesh and stops him from raping a bride on her wedding night - as was his custom. (This custom was the catalyst for the people complaining to the gods about Gilgamesh and their creation of Enkidu.) After they fight over this, Enkidu and Gilgamesh become great friends who share adventures and companionship.

Finally, Enkidu learns of his mortality. Facing death terrifies him and he curses Shamhat, who initiated him into civilization. In truth, though, Enkidu was always mortal but was simply unaware of it when he was more animal than human. While still filled with trepidation about death, he is consoled by the gods with the memory of all that he has gained by joining civilization: food and drink that have sustained and delighted him, beautiful clothing he wears, honors of which he is proud, and above all his deep friendship with Gilgamesh. Enkidu dies.

Gilgamesh is thrown into deep mourning at the loss of his friend. He, too, is saddened and terrified by the prospect of death and seeks out ways to avoid it. In his search for immortality he encounters an alewife who delivers this advice:

----------------

[Your loyal blogger's voice]

It isn't about avoiding death; it's about embracing life.

This reveling in the normal, realizing how extraordinary is the ordinary, seems to me a much richer way to enjoy life than to insist that we do great things or strive to fall into the top 0.01%. In that direction lies failure for 99.99%, and that's tragic. Learning to delight in the common things promises delight for anyone who can realize the gift of civilized humanity, the promise of the pursuit of happiness.

----------------

Gilgamesh was written by Sin-lequi-unninni. All that is known of him is that he probably compiled materials - texts and oral legends - that reached far back into the past.

The Torah was probably assembled in the fifth century BCE; the Iliad somewhat earlier, perhaps between 760 and 710 BCE. But Sin-lequi-unninni wrote his text sometime between 1300 and 1000 BCE, and the earliest surviving written tales of Gilgamesh date from around 2100 BCE. Older by more than a thousand years than either Homer or the Bible, Gilgamesh is quite possibly the oldest story ever found. [And what follows is just a portion of that epic of Gilgamesh.]

The Torah was probably assembled in the fifth century BCE; the Iliad somewhat earlier, perhaps between 760 and 710 BCE. But Sin-lequi-unninni wrote his text sometime between 1300 and 1000 BCE, and the earliest surviving written tales of Gilgamesh date from around 2100 BCE. Older by more than a thousand years than either Homer or the Bible, Gilgamesh is quite possibly the oldest story ever found. [And what follows is just a portion of that epic of Gilgamesh.]Uruk was the first city in the ancient Near East and perhaps the first city in human history and the creation story of Gilgamesh starts there. This isn't the story of the origin of humans. This is the story of the origination of humanity, told through a being named Enkidu who is transformed from beast to man.

The people of Uruk are terrorized by Gilgamesh who is one-third human and two-thirds god. He's a great builder and warrior but his sexual appetites are terrorizing the city. In response to the complaints about him from the people of Uruk, the gods create Enkidu who is placed - not in the city but - in the wilderness outside the city.

Enkidu roams naked with gazelles, a wild creature with hair covering his whole body. Then he meets Shamhat.

Shamhat is a temple prostitute skilled in all pleasures. Shamhat and Enkidu spend six days and seven nights in fervent lovemaking and at the end of this time, when Enkidu tries to rejoin the gazelles he cannot. This - the love of Shamhat - has changed him. He is no longer an animal.

Shamhat continues Enkidu's initiation. He cleans himself and seems to lose the hair covering his body. He eats at a table. She takes off her clothes and shares them with him (one for me, one for you style), clothing becoming a sign of culture rather than a covering for shame.

Next comes friendship. Enkidu meets Gilgamesh and stops him from raping a bride on her wedding night - as was his custom. (This custom was the catalyst for the people complaining to the gods about Gilgamesh and their creation of Enkidu.) After they fight over this, Enkidu and Gilgamesh become great friends who share adventures and companionship.

Finally, Enkidu learns of his mortality. Facing death terrifies him and he curses Shamhat, who initiated him into civilization. In truth, though, Enkidu was always mortal but was simply unaware of it when he was more animal than human. While still filled with trepidation about death, he is consoled by the gods with the memory of all that he has gained by joining civilization: food and drink that have sustained and delighted him, beautiful clothing he wears, honors of which he is proud, and above all his deep friendship with Gilgamesh. Enkidu dies.

Gilgamesh is thrown into deep mourning at the loss of his friend. He, too, is saddened and terrified by the prospect of death and seeks out ways to avoid it. In his search for immortality he encounters an alewife who delivers this advice:

As for you Gilgamesh, let your stomach be full,The alewife's words epitomize the wisdom of the everyday, the advice summoned up by the spectacle of too much heroic striving: know your limits, accept the human condition, savor the ordinary sweet pleasures that life offers. "This, then," she concludes, "is the work of mankind."

Always be happy, night and day,

Make every day a delight,

Night and day, play and dance.

Your clothes should be clean,

Your head should be washed,

You should bathe in water.

Look proudly on the little one holding your hand,

Let your mate be always blissful in your loins

----------------

[Your loyal blogger's voice]

It isn't about avoiding death; it's about embracing life.

This reveling in the normal, realizing how extraordinary is the ordinary, seems to me a much richer way to enjoy life than to insist that we do great things or strive to fall into the top 0.01%. In that direction lies failure for 99.99%, and that's tragic. Learning to delight in the common things promises delight for anyone who can realize the gift of civilized humanity, the promise of the pursuit of happiness.

02 December 2017

Why the Republican Tax Cuts Won't Help the Economy: Understanding the Difference Between the Economies and Parties of Lincoln and Trump

Trillions in excess reserves, cash and negative interest rate bonds calls into question Republican's claim that the economy needs tax cuts to create additional capital.

Abraham Lincoln was the first Republican president. He was part of a visionary party who realized that the industrial economy had changed the rules in a few ways. One, it made capital even more important than land. Two, it made slavery, which was always immoral, now bad economics. Three, it made the national economy most relevant to good policy (goods now produced in growing factories were now transported across state lines by growing railroads to be sold in department stores all across the country) rather than the old state economy. When the south seceded, the largely Republican northern legislators passed a flurry of laws to accommodate this new industrial economy that was supplanting the agricultural economy.

Since the time of Lincoln, a key to understanding Republican policy and strategy is understanding that they believe that nothing is more important to economic prosperity than capital.

There is good reason for such a belief. If you are working with your bare hands you do well to create more than a few pennies - maybe a few dollars - of value a day. If you have capital equipment like a vehicle, a lathe, a computer or factory, you can potentially create thousands - even millions - of dollars in value each day.

The thinking behind the Republican tax breaks traces back to this belief that they need to encourage more investment by corporations by taxing them less. Their belief is that as more money is invested in things like lathes, computers and factories, American workers will be more productive. As it has since the time of Lincoln, more capital from more investments will make us more prosperous.

It is true that capital is essential to our economy. So is agriculture. There is a difference, though, between knowing that we'd perish without farmers and expecting agriculture to employ a growing number of people. In 1800 about 90% of Americans worked in agriculture; by 2017, about 1 or 2% do. Agriculture is essential but that is very different from saying that more farmers will make our country more prosperous. Agriculture is not the place we look in 2017 for the creation of new jobs and wealth.

Capital, too, is essential but that is different from saying that more capital will make us more prosperous. Manufacturing (admittedly just one manifestation of capital) is not the place we look in 2017 for the creation of new jobs and wealth. As farming before it, jobs in manufacturing have been in steady decline as a percentage of the workforce since about 1940.

Again, the simple justification for Republican tax cuts is the belief that they will result in more capital investment. The story of excess reserves calls that into question.

From the early 1980s through 2008, excess reserves in the US banking system mostly bounced around between $1 and $2 billion dollars. Banks are required to keep a certain level of reserves on hand, essentially money they hold in case you come in to make a withdrawal on your account. And simply because it is nearly impossible to have every dime "working" as loans, etc., banks also keep a little reserves in excess of what is required. They have an incentive to keep these reserves to a minimum because they just sit there idle, generating no interest, so it makes sense that they wouldn't hold much in excess reserves.

Then we got hit with the Great Recession. One huge risk was that the credit system would collapse. Among other things, the Fed pumped capital into the banking system to encourage economic activity. The Fed could put capital into the banking system but banks had to put it out into the economy via loans to households and businesses.

Banks are literally professionals at understanding credit risk and knowing when to loan money for a kitchen remodel or a business expansion. Bankers - like business executives, teachers, police, and engineers - make mistakes but this matter of deciding where capital should be employed to maximize the returns on capital is quite literally their job. If they have a billion dollars, they will look for a way to invest or loan that out in order to create a return. Only as a last resort will they leave it idle and not making money.

So what happened when the Fed pumped a record amount of money into the banking system? You can see that below; the one to two BILLION became two to three TRILLION, a jump of 1,000X.

Janet Yellen has helped to engineer a draw down of these excess reserves without disrupting the economy but after peaking at $2.7 TRILLION in 2014, excess reserves are still $2.2 trillion.

Bankers - the experts on capital allocation - are letting trillions sit idle because they don't see profitable ways to employ this capital. Another way to put it is that they don't see capital as scarce.

Excess reserves are not the only bits of evidence that the economy has an abundance of capital. Last year companies in the S&P 500 spent $536.4 billion on buybacks. What does that mean? They spent half a trillion simply buying their own stock rather than investing that money into hiring, factory expansion, or advertising. Like bankers, big corporations don't see capital as scarce but instead see it as abundant, literally having more than they can use. Corporate cash is close to $2 trillion.

The Dutch have financial records that go back 500 years. Think about all that has transpired since 1517: the Protestant Revolution and religious wars that killed tens of percent of the population in certain regions of Europe, coming to an understanding that Columbus had actually discovered new continents and then settling those Americas, democratic revolutions, the industrial revolution, world wars, a Great Depression .... these 500 years have hardly been uneventful. And yet, last year was the first time that the Dutch recorded the sale of negative interest rate bonds. You give a country $100 and get back $99. The Netherlands, the EU, France, Japan .... nine countries had issued about $12 trillion in negative interest rate bonds as of last year

To sum up, US banks have $2.2 trillion in reserves, the S&P 500 has $2 trillion in cash (even while spending half a trillion a year on buybacks), and there are more than $12 trillion in negative interest rate bonds around the world.

None of this suggests that the West faces a scarcity of capital.

So let's get back to the Republican tax cut. The thinking behind it is simple: if we tax less there will be more capital and that capital can be employed to expand businesses that will generate more profit and jobs. And that, of course, assumes that capital is scarce.

Capital was scarce 150 years ago during Lincoln's presidency. At that time, nearly any policies that encouraged the growth of capital were likely to have a positive effect on the economy, helping to make us all more prosperous.

Capital is now abundant. Policies that starve public education and research to send back more capital to corporations and individuals will hurt economic growth, not help it. There is no way that someone can look at the evidence and conclude that what our economy lacks now is capital. There is no way, of course, unless you have failed to update what was once a great perspective to adjust to a new landscape. The party of Lincoln has given way to the party of Trump and mindful intelligence that carefully considers new facts has given way to mindless ideology that ignores them.

Abraham Lincoln was the first Republican president. He was part of a visionary party who realized that the industrial economy had changed the rules in a few ways. One, it made capital even more important than land. Two, it made slavery, which was always immoral, now bad economics. Three, it made the national economy most relevant to good policy (goods now produced in growing factories were now transported across state lines by growing railroads to be sold in department stores all across the country) rather than the old state economy. When the south seceded, the largely Republican northern legislators passed a flurry of laws to accommodate this new industrial economy that was supplanting the agricultural economy.

Since the time of Lincoln, a key to understanding Republican policy and strategy is understanding that they believe that nothing is more important to economic prosperity than capital.

There is good reason for such a belief. If you are working with your bare hands you do well to create more than a few pennies - maybe a few dollars - of value a day. If you have capital equipment like a vehicle, a lathe, a computer or factory, you can potentially create thousands - even millions - of dollars in value each day.

The thinking behind the Republican tax breaks traces back to this belief that they need to encourage more investment by corporations by taxing them less. Their belief is that as more money is invested in things like lathes, computers and factories, American workers will be more productive. As it has since the time of Lincoln, more capital from more investments will make us more prosperous.

It is true that capital is essential to our economy. So is agriculture. There is a difference, though, between knowing that we'd perish without farmers and expecting agriculture to employ a growing number of people. In 1800 about 90% of Americans worked in agriculture; by 2017, about 1 or 2% do. Agriculture is essential but that is very different from saying that more farmers will make our country more prosperous. Agriculture is not the place we look in 2017 for the creation of new jobs and wealth.

Capital, too, is essential but that is different from saying that more capital will make us more prosperous. Manufacturing (admittedly just one manifestation of capital) is not the place we look in 2017 for the creation of new jobs and wealth. As farming before it, jobs in manufacturing have been in steady decline as a percentage of the workforce since about 1940.

Again, the simple justification for Republican tax cuts is the belief that they will result in more capital investment. The story of excess reserves calls that into question.

From the early 1980s through 2008, excess reserves in the US banking system mostly bounced around between $1 and $2 billion dollars. Banks are required to keep a certain level of reserves on hand, essentially money they hold in case you come in to make a withdrawal on your account. And simply because it is nearly impossible to have every dime "working" as loans, etc., banks also keep a little reserves in excess of what is required. They have an incentive to keep these reserves to a minimum because they just sit there idle, generating no interest, so it makes sense that they wouldn't hold much in excess reserves.

Then we got hit with the Great Recession. One huge risk was that the credit system would collapse. Among other things, the Fed pumped capital into the banking system to encourage economic activity. The Fed could put capital into the banking system but banks had to put it out into the economy via loans to households and businesses.

Banks are literally professionals at understanding credit risk and knowing when to loan money for a kitchen remodel or a business expansion. Bankers - like business executives, teachers, police, and engineers - make mistakes but this matter of deciding where capital should be employed to maximize the returns on capital is quite literally their job. If they have a billion dollars, they will look for a way to invest or loan that out in order to create a return. Only as a last resort will they leave it idle and not making money.

So what happened when the Fed pumped a record amount of money into the banking system? You can see that below; the one to two BILLION became two to three TRILLION, a jump of 1,000X.

Janet Yellen has helped to engineer a draw down of these excess reserves without disrupting the economy but after peaking at $2.7 TRILLION in 2014, excess reserves are still $2.2 trillion.

Bankers - the experts on capital allocation - are letting trillions sit idle because they don't see profitable ways to employ this capital. Another way to put it is that they don't see capital as scarce.

Excess reserves are not the only bits of evidence that the economy has an abundance of capital. Last year companies in the S&P 500 spent $536.4 billion on buybacks. What does that mean? They spent half a trillion simply buying their own stock rather than investing that money into hiring, factory expansion, or advertising. Like bankers, big corporations don't see capital as scarce but instead see it as abundant, literally having more than they can use. Corporate cash is close to $2 trillion.

The Dutch have financial records that go back 500 years. Think about all that has transpired since 1517: the Protestant Revolution and religious wars that killed tens of percent of the population in certain regions of Europe, coming to an understanding that Columbus had actually discovered new continents and then settling those Americas, democratic revolutions, the industrial revolution, world wars, a Great Depression .... these 500 years have hardly been uneventful. And yet, last year was the first time that the Dutch recorded the sale of negative interest rate bonds. You give a country $100 and get back $99. The Netherlands, the EU, France, Japan .... nine countries had issued about $12 trillion in negative interest rate bonds as of last year

To sum up, US banks have $2.2 trillion in reserves, the S&P 500 has $2 trillion in cash (even while spending half a trillion a year on buybacks), and there are more than $12 trillion in negative interest rate bonds around the world.

None of this suggests that the West faces a scarcity of capital.

So let's get back to the Republican tax cut. The thinking behind it is simple: if we tax less there will be more capital and that capital can be employed to expand businesses that will generate more profit and jobs. And that, of course, assumes that capital is scarce.

Capital was scarce 150 years ago during Lincoln's presidency. At that time, nearly any policies that encouraged the growth of capital were likely to have a positive effect on the economy, helping to make us all more prosperous.

Capital is now abundant. Policies that starve public education and research to send back more capital to corporations and individuals will hurt economic growth, not help it. There is no way that someone can look at the evidence and conclude that what our economy lacks now is capital. There is no way, of course, unless you have failed to update what was once a great perspective to adjust to a new landscape. The party of Lincoln has given way to the party of Trump and mindful intelligence that carefully considers new facts has given way to mindless ideology that ignores them.

24 November 2017

The Economic Effects of the Republican Tax Plan - Punishing Work and Rewarding Luck

Although the Republican tax plan has been - and still is - evolving it has recently included changes that would tax innovation in two forms. One, grad students who receive a scholarship will be required to pay income tax on it's value. If you get a $45,000 a year scholarship to Stanford, you would have to report that as income. Two, any stock options granted to employees would be taxed at the point they are granted, not - as they are now - taxed at the point when they are exercised. As it is, this tax will make it harder for people to get PhDs and to launch startups. What do these two things have in common? They threaten the status quo and can unleash gales of creative destruction.

The bad news about new ideas, technologies and businesses that come out of grad school and startups is that they can overturn existing industries. Your hotels could be undermined by Airbnb. Your oil well can be undermined by affordable solar panels.

There are two groups who are threatened by the gales of creative destruction. One group is the elites who own existing hotel chains, oil wells and other assets whose value can be eroded by the new. The other group are the folks who work for these elites and share their concern that innovation could disrupt their livelihood, people who may lose their coal mining jobs.

So startups and grad students are being taxed more but the Republican plan is advertised as a tax cut. So, who pays less? The folks who will get the most dramatic tax cut are the folks who inherit. Current law is already ridiculously generous to folks who inherit: if the value of the estate you inherit is $5.45 million, you don't have to pay a dime in inheritance tax. This new plan will double that.

Republicans are rewarding people who resist change by simply inheriting and punishing people who are encouraging change. This is not particularly surprising for social conservatives, people who see as a threat most change from the world they learned.

I recently put out a survey to ask this question:

Put aside for a moment whether you think that the highest marginal tax rate should be 5% or 95%. This question is about something else. Which of the following do you think should be taxed at the highest marginal rate?

My respondents clearly thought that the highest marginal tax rate should be applied to the income that came with the least personal effort: inheritance tax. This is the opposite of what Republican leaders believe, proposing a plan that levies the highest tax on the people who apply the most effort: the people who are out earning an income rather than leaving that job to their investments or grandparents.

Taxing inheritance the highest isn't just about fairness. If we want a society where everyone has an incentive to work, we would want a society where work is taxed less than inheritance and one person isn't free of tax on the first $10 million they inherit while another person has to pay income tax as soon as she makes more than $10,000. That is partly about fairness but it is also just common sense: we want everyone to help with the work.

The older I get the more confident I am about what makes for good policy and the less confident I am about what makes for good politics. On the face of it, a Republican tax plan that hikes up the deficit by an additional $2 trillion, gives tax breaks to rich grandkids, and discourages entrepreneurship and education would seem like taping a sign to your back that says, "Vote for the other guy." Who knows, though. It might just be that the American people will fall in love with a plan that helps to discourage the progress that so many find disruptive.

The bad news about new ideas, technologies and businesses that come out of grad school and startups is that they can overturn existing industries. Your hotels could be undermined by Airbnb. Your oil well can be undermined by affordable solar panels.

There are two groups who are threatened by the gales of creative destruction. One group is the elites who own existing hotel chains, oil wells and other assets whose value can be eroded by the new. The other group are the folks who work for these elites and share their concern that innovation could disrupt their livelihood, people who may lose their coal mining jobs.

So startups and grad students are being taxed more but the Republican plan is advertised as a tax cut. So, who pays less? The folks who will get the most dramatic tax cut are the folks who inherit. Current law is already ridiculously generous to folks who inherit: if the value of the estate you inherit is $5.45 million, you don't have to pay a dime in inheritance tax. This new plan will double that.

Republicans are rewarding people who resist change by simply inheriting and punishing people who are encouraging change. This is not particularly surprising for social conservatives, people who see as a threat most change from the world they learned.

I recently put out a survey to ask this question:

Put aside for a moment whether you think that the highest marginal tax rate should be 5% or 95%. This question is about something else. Which of the following do you think should be taxed at the highest marginal rate?

- Income tax: I think money you make from your job, your labor, should be taxed at the highest rate

- Capital gains tax: I think that money you make from your investments should be taxed at the highest rate

- Inheritance tax: I think the money you get from inheritance should be taxed at the highest rate

- Consumption tax: I think the money you spend (on groceries, transportation, housing, clothes, entertainment and other consumption goods) should be taxed at the highest rate

The responses were as follows:

Taxing inheritance the highest isn't just about fairness. If we want a society where everyone has an incentive to work, we would want a society where work is taxed less than inheritance and one person isn't free of tax on the first $10 million they inherit while another person has to pay income tax as soon as she makes more than $10,000. That is partly about fairness but it is also just common sense: we want everyone to help with the work.

The older I get the more confident I am about what makes for good policy and the less confident I am about what makes for good politics. On the face of it, a Republican tax plan that hikes up the deficit by an additional $2 trillion, gives tax breaks to rich grandkids, and discourages entrepreneurship and education would seem like taping a sign to your back that says, "Vote for the other guy." Who knows, though. It might just be that the American people will fall in love with a plan that helps to discourage the progress that so many find disruptive.

16 November 2017

Some Thoughts on Sex Scandals, Politics, Culture and Consent

As I write this, Twitter is a twitter about sex. At least for the accounts I follow, that's unusual.

The two big stories are Roy Moore and Al Franken. The left is appalled that Moore won't drop out of the senate race and is asking Franken to resign.

There is a line of Shakespeare, "First let's kill all the lawyers," that seems to describe what so often happens in political arguments. The point should be to clearly define terms as lawyers would do but instead, on this discussion, we're killing off all efforts at clarity and lumping a lot of behavior under the heading of "sexual misconduct."

In Roy Moore's mind, sexual misconduct does include consenting adults engaged in homosexual behavior but does not include a 32 year old man groping and touching a 14 year old girl he met at a child custody hearing.

In Donald Trump's mind, sexual misconduct does not include grabbing women's pussies or kissing them because they are so beautiful or regularly having affairs. Sexual misconduct does include whatever it is that Al Franken is doing.

In Al Franken's mind, because he's a conscientious liberal, sexual misconduct is anything guys like Moore and Trump have done AND anything he - Al Franken - may have done that would upset his constituents.

------------